Best robo-advisors for 2024 sets the stage for the latest trends in automated investment platforms. Get ready for a deep dive into the world of finance with a twist of modern technology and innovation.

From the types of robo-advisors to key features and performance analysis, this guide will equip you with the knowledge needed to navigate the dynamic landscape of investment options.

Types of Robo-Advisors

Robo-advisors come in different types to cater to various investment preferences and needs. Let’s explore the main categories and features of these automated investment platforms.

Passive vs. Active Robo-Advisors

Passive robo-advisors focus on creating a diversified portfolio based on your risk tolerance and investment goals. These platforms typically follow a buy-and-hold strategy, aiming to match the performance of a specific market index. In contrast, active robo-advisors involve more frequent trading and attempt to outperform the market through strategic buying and selling of assets. While passive robo-advisors offer lower fees and are less hands-on, active robo-advisors may provide the potential for higher returns but come with higher costs.

Hybrid Robo-Advisors

Hybrid robo-advisors combine the benefits of automated algorithms with human financial advisors. These platforms offer a blend of technology-driven investment management and personalized advice from professionals. Hybrid robo-advisors are suitable for investors who seek a balance between automated portfolio management and human expertise. By leveraging the strengths of both automated and human assistance, hybrid robo-advisors aim to provide a more holistic approach to financial planning and investment management.

Features to Consider

When choosing the best robo-advisor for your investment needs in 2024, there are several key features to keep in mind. These features can have a significant impact on the performance and overall experience of using a robo-advisor.

Low Fees and Minimum Investment Requirements

- Low fees are essential when selecting a robo-advisor, as they can eat into your returns over time. Look for platforms that offer competitive fees compared to traditional financial advisors.

- Minimum investment requirements can also vary among robo-advisors. Make sure to choose one that aligns with your budget and financial goals.

Customizable Portfolios and Tax-Loss Harvesting Capabilities

- Customizable portfolios allow you to tailor your investments based on your risk tolerance, financial goals, and preferences. This feature can help you achieve a more personalized investment strategy.

- Tax-loss harvesting capabilities are crucial for optimizing your tax situation. This feature involves selling investments at a loss to offset gains and reduce taxable income, ultimately saving you money on taxes.

Performance and Returns

Robo-advisors have shown a track record of delivering consistent returns over time, thanks to their algorithm-based investment strategies. These platforms use technology to automatically rebalance portfolios, optimize tax efficiency, and minimize fees, which can result in better returns for investors.

Top-Performing Robo-Advisors and Strategies

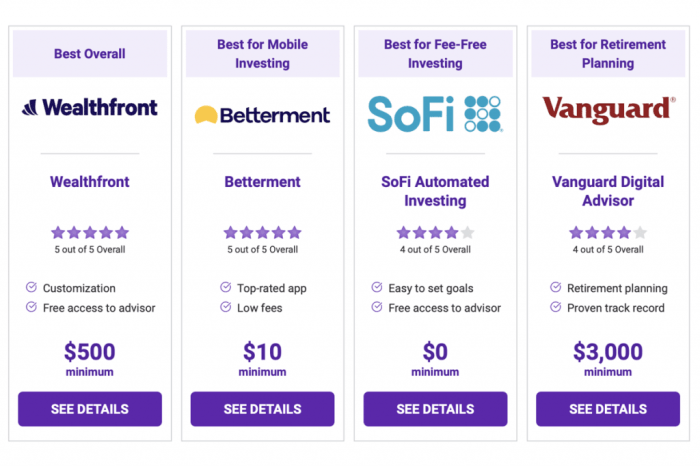

- Wealthfront: Wealthfront is known for its diversified portfolio strategies that focus on low-cost index funds and tax-loss harvesting to maximize returns.

- Betterment: Betterment utilizes a goal-based investing approach, personalized asset allocation, and tax-efficient strategies to deliver competitive returns.

- Schwab Intelligent Portfolios: Schwab’s robo-advisor combines ETFs and cash to create diversified portfolios personalized to individual goals and risk tolerance levels.

Factors Influencing Robo-Advisor Performance, Best robo-advisors for 2024

- Market Conditions: Economic trends and market volatility can impact the performance of robo-advisors, affecting returns for investors.

- Asset Allocation: The allocation of assets in a portfolio plays a crucial role in determining returns, with a focus on diversification and risk management.

- Fees and Expenses: High fees can eat into returns, so choosing a robo-advisor with low fees is essential for maximizing investment performance.

- Rebalancing Strategies: Regular portfolio rebalancing ensures that investments stay aligned with the intended risk-return profile, contributing to overall performance.

Security and Trust: Best Robo-advisors For 2024

Robo-advisors play a crucial role in managing investors’ assets, which makes security and trust essential aspects of their services. Let’s delve into the security measures, regulatory compliance, and data protection practices that the best robo-advisors should uphold.

Security Measures

- Robo-advisors should utilize encryption protocols to safeguard sensitive information, such as account details and personal data, from unauthorized access.

- Implementing multi-factor authentication adds an extra layer of security, ensuring that only authorized users can access the platform and make transactions.

- Regular security audits and updates are vital to identify and address vulnerabilities promptly, minimizing the risk of cyber attacks.

Regulatory Compliance and Transparency

- Compliance with regulatory bodies like the SEC (Securities and Exchange Commission) is crucial for building trust with clients, as it ensures that the robo-advisor operates within legal boundaries.

- Transparency in fee structures, investment strategies, and potential risks fosters trust and helps investors make informed decisions about their financial goals.

- Providing clear and accessible information about the company’s background, team expertise, and regulatory licenses enhances credibility and trustworthiness.

Data Privacy and Cyber Threat Protection

- Robo-advisors should have robust data privacy policies in place to protect clients’ personal and financial information from unauthorized sharing or misuse.

- Regularly updating security systems and employing advanced cybersecurity measures help mitigate the risk of data breaches and cyber threats.

- Utilizing secure data storage practices, such as encryption and secure servers, ensures that client data is safeguarded against potential cyber attacks.