Yo, diving into some stock picking tips! Get ready for a wild ride as we explore different strategies, analysis techniques, and risk management in the world of stocks. It’s gonna be lit!

Let’s break down the key aspects of stock picking, from fundamental and technical analysis to managing risks like a pro. Stay tuned for some expert advice and examples to level up your stock game.

Stock Picking Strategies

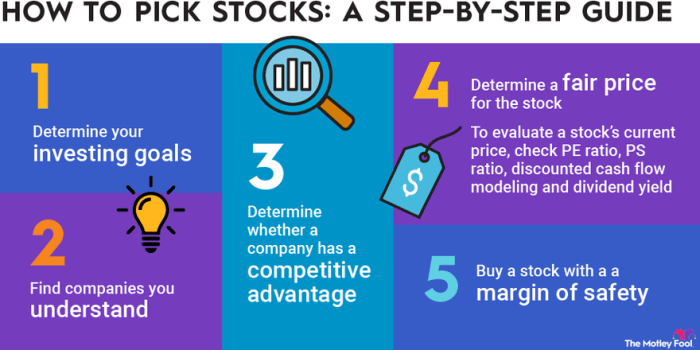

When it comes to selecting stocks, there are various strategies that investors can utilize to make informed decisions. Diving into the world of stock picking requires a combination of research, analysis, and a solid understanding of the market.

Diversification in Stock Picking

Diversification is a key principle in stock picking that involves spreading your investments across different asset classes to reduce risk. By diversifying your portfolio, you can minimize the impact of a single stock’s performance on your overall investment.

Value Investing in Stock Picking

Value investing is a strategy where investors look for undervalued stocks that have the potential for long-term growth. This approach involves analyzing financial statements, evaluating the company’s intrinsic value, and investing in stocks that are trading below their true worth.

Remember, the goal of value investing is to buy low and sell high.

Successful Stock Picking Strategies

Many successful investors have employed various strategies to pick winning stocks. For example, Warren Buffett is known for his value investing approach, while Peter Lynch focused on investing in companies that he understood and believed in.

Other strategies include growth investing, momentum investing, and contrarian investing, each with its own set of principles and techniques.

Fundamental Analysis

Fundamental analysis is a method used to evaluate a stock by examining the core financial and economic factors that influence its value. This type of analysis helps investors to determine the intrinsic value of a stock and assess whether it is overvalued, undervalued, or fairly priced.

Key Fundamental Indicators

- Earnings Per Share (EPS): This indicator shows the company’s profitability and helps investors understand how much profit each share generates.

- Price to Earnings (P/E) Ratio: This ratio compares the stock price to the company’s earnings and indicates if the stock is expensive or cheap relative to its earnings.

- Debt to Equity Ratio: This ratio measures the company’s financial leverage and shows the proportion of debt used to finance its operations.

- Revenue Growth: Analyzing the company’s revenue growth over time can provide insights into its competitive position and future prospects.

Interpreting Financial Statements, Stock picking tips

Financial statements like the income statement, balance sheet, and cash flow statement are crucial for fundamental analysis. Investors can analyze these statements to assess the company’s financial health, profitability, liquidity, and overall performance. By examining revenue trends, expense management, debt levels, and cash flow patterns, investors can make informed decisions about stock investments.

Comparison with Other Methods

Fundamental analysis differs from other stock picking methods like technical analysis, which focuses on price trends and patterns. While technical analysis relies on historical price data and market psychology, fundamental analysis looks at the underlying factors driving a company’s value. Investors can use a combination of both approaches to gain a comprehensive understanding of a stock’s potential and make well-informed investment decisions.

Technical Analysis

Technical analysis plays a crucial role in stock picking by focusing on historical price movements and trading volumes to predict future price trends. It helps traders and investors make informed decisions based on market trends and patterns.

Common Technical Indicators

When analyzing stock price movements, there are several common technical indicators that are widely used:

- Moving Averages – These help smooth out price data to identify trends over a specific time period.

- Relative Strength Index (RSI)

-Indicates whether a stock is overbought or oversold, helping to determine potential reversal points. - Bollinger Bands – Show the volatility of a stock by plotting two standard deviations away from a simple moving average.

Reading Stock Charts Effectively

Reading stock charts effectively is essential for making informed decisions. Here are some tips:

- Identify support and resistance levels to determine potential entry and exit points.

- Look for chart patterns such as head and shoulders, flags, and triangles that can indicate potential price movements.

- Use candlestick patterns to analyze price action and sentiment in the market.

Successful Stock Picks Based on Technical Analysis

Successful stock picks based on technical analysis involve identifying trends and patterns to make profitable trades. For example, a trader might use moving averages to confirm a trend and then use RSI to find entry points for buying or selling stocks.

Risk Management: Stock Picking Tips

In the world of stock picking, managing risk is crucial to protect your investments and maximize potential returns. By implementing effective risk management strategies, investors can minimize losses and increase the chances of success in the stock market.

Importance of Risk Management

- Setting stop-loss orders to limit potential losses

- Diversifying your portfolio to spread risk across different assets

- Conducting thorough research and analysis before making investment decisions

Different Strategies for Managing Risk

- Utilizing options contracts for hedging purposes

- Implementing position sizing techniques to control the amount of capital at risk

- Regularly reviewing and adjusting your investment strategy based on market conditions

Determining Risk-Reward Ratio

- Calculate the ratio by dividing the potential reward by the amount of risk undertaken

- Consider the probability of success and potential downside before making investment decisions

- Adjust your risk-reward ratio based on your risk tolerance and investment goals

Impact of Risk Management on Stock Picking

- Proper risk management can help investors avoid catastrophic losses in volatile market conditions

- By following a disciplined risk management approach, investors can enhance their long-term performance and achieve consistent returns

- Failure to implement effective risk management strategies can lead to significant financial setbacks and missed opportunities