Kicking off with Understanding Lifetime Customer Value, this opening paragraph is designed to captivate and engage the readers with a fresh perspective on how businesses can harness the power of customer relationships for long-term success.

Dive into the world of customer value and discover the strategies and factors that drive businesses towards sustainable growth and profitability.

Importance of Lifetime Customer Value

Understanding lifetime customer value is crucial for businesses as it helps in making informed decisions regarding customer acquisition, retention, and overall marketing strategies.

Impact on Marketing Strategies

Knowing the lifetime value of a customer can significantly impact marketing strategies by allowing businesses to allocate resources effectively. For example, if a company determines that a certain segment of customers has a high lifetime value, they can tailor their marketing campaigns to specifically target and retain those customers, ultimately increasing revenue and profitability.

Contribution to Long-Term Business Success

Lifetime customer value contributes to long-term business success by focusing on building relationships with customers rather than just one-time transactions. By understanding the value of each customer over their lifetime, businesses can prioritize customer satisfaction, loyalty, and retention, leading to sustainable growth and profitability in the long run.

Calculating Lifetime Customer Value

Lifetime Customer Value (LCV) is a crucial metric for businesses to understand the long-term value of their customers. Calculating LCV involves a specific formula that takes into account various factors to determine the total value a customer brings to a company over the course of their relationship.

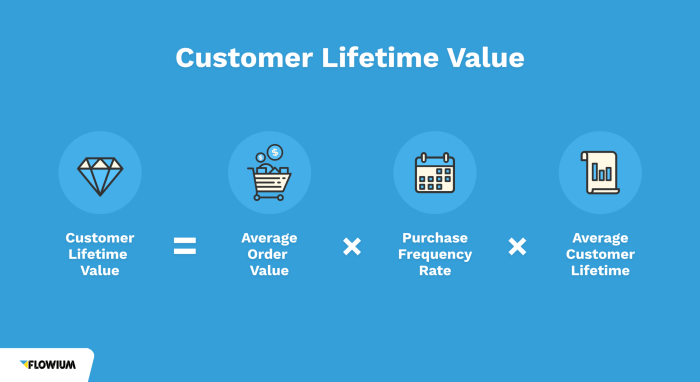

Formula for Calculating LCV

Lifetime Customer Value = Average Purchase Value x Average Purchase Frequency x Customer Lifespan

- Average Purchase Value: This is the average amount of money a customer spends with each purchase.

- Average Purchase Frequency: This refers to how often a customer makes a purchase within a specific time frame.

- Customer Lifespan: The duration of time a customer continues to engage with a company or make purchases.

Examples of Calculating LCV

- Example 1: A subscription-based business calculates LCV by multiplying the monthly subscription fee (Average Purchase Value) by the average number of months a customer remains subscribed (Customer Lifespan).

- Example 2: An e-commerce store calculates LCV by multiplying the average order value (Average Purchase Value) by the number of orders placed in a year (Average Purchase Frequency) and the average number of years a customer continues to shop with them (Customer Lifespan).

Significance of Accurate Data Input

Accurate data input is essential when calculating LCV as it directly impacts the reliability and precision of the results. Inaccurate data can lead to faulty calculations and misinterpretations of a customer’s value to the business. Therefore, businesses must ensure that they collect and analyze data meticulously to derive meaningful insights from their LCV calculations.

Factors Influencing Lifetime Customer Value

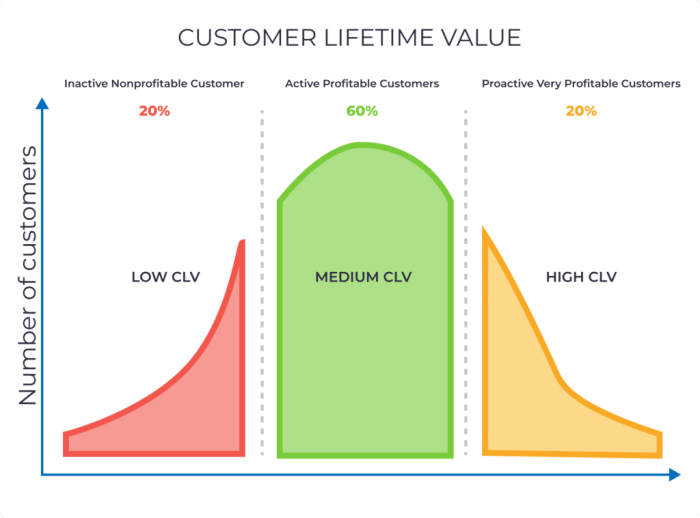

Understanding the key factors that influence lifetime customer value is crucial for businesses looking to maximize their revenue and build strong customer relationships. These factors can vary across different industries based on their unique characteristics and customer behaviors.

Customer Behavior

Customer behavior plays a significant role in determining lifetime customer value. Factors such as purchase frequency, average order value, and product preferences can impact how much a customer is worth to a business over their lifetime.

Customer Loyalty

Customer loyalty is another key factor that influences lifetime customer value. Loyal customers are more likely to make repeat purchases and recommend the business to others, increasing their overall value over time.

Customer Retention

Customer retention is essential for maximizing lifetime customer value. Retaining existing customers is often more cost-effective than acquiring new ones, and loyal customers tend to spend more over their lifetime with a business.

Strategies to Enhance Lifetime Customer Value: Understanding Lifetime Customer Value

Enhancing lifetime customer value is crucial for the long-term success of a business. By implementing proven strategies, companies can increase customer loyalty and drive revenue growth.

1. Personalized Marketing Campaigns

Creating personalized marketing campaigns based on customer preferences and behavior can significantly increase lifetime customer value. By tailoring promotions and offers to individual customers, businesses can foster stronger relationships and drive repeat purchases.

2. Loyalty Programs, Understanding Lifetime Customer Value

Implementing a loyalty program rewards customers for their continued business, encouraging repeat purchases and increasing customer retention. For example, Starbucks’ loyalty program offers free drinks and personalized offers to frequent customers, driving increased customer engagement and lifetime value.

3. Exceptional Customer Service

Providing exceptional customer service can enhance the overall customer experience, leading to higher satisfaction levels and increased loyalty. Companies like Zappos have built a loyal customer base by prioritizing customer service and going above and beyond to meet customer needs.

4. Cross-Selling and Upselling

Utilizing cross-selling and upselling techniques can help increase the average transaction value and lifetime customer value. Amazon is a prime example of effectively implementing cross-selling by recommending complementary products to customers based on their purchase history.

5. Continuous Engagement

Engaging with customers on a regular basis through various channels such as email marketing, social media, and personalized recommendations can help maintain a strong relationship and encourage repeat purchases. Companies like Sephora keep customers engaged by providing personalized product recommendations and exclusive offers.